Panama City Mayor Proposes Bitcoin Discounts for Panama Canal Transit Fees

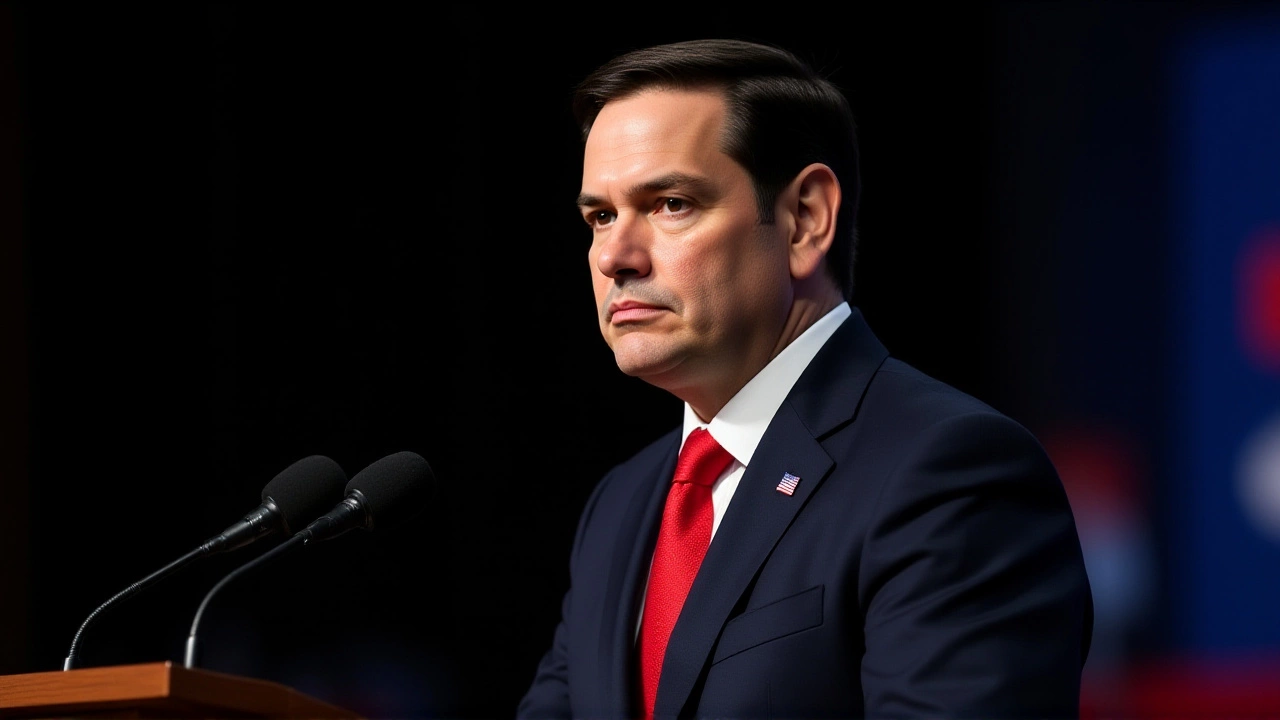

When Mayer Mizrachi, Mayor of Panama City, stood at the Bitcoin 2025 conference in Las Vegas on August 7, 2025, he didn’t just talk about digital currency—he dropped a bombshell for global shipping: ships paying tolls at the Panama Canal in Bitcoin could get discounts and skip the line. It’s not science fiction. It’s policy. And it’s moving fast.

Why This Matters to Global Trade

The Panama Canal isn’t just a waterway. It’s a chokepoint. Every year, roughly 14,000 vessels—carrying $500 billion in cargo—squeeze through its 82-kilometer stretch. That’s 3% of all global maritime trade. And right now, those ships pay nearly $5 billion in fees annually, all in U.S. dollars. But what if they could pay in Bitcoin instead? And what if that payment came with a perk—faster transit?Mizrachi’s idea isn’t just about money. It’s about efficiency. Shipping companies wait 15 to 20 days during peak seasons. Delays cost millions. A 10% discount on tolls, paired with priority passage, could be irresistible. And if even 15% of transits switched to Bitcoin? That’s $750 million in annual crypto inflow. A Strategic Bitcoin Reserve, as Max Keiser calls it, could transform Panama’s fiscal position overnight.

The Ripple Effect: From Taxes to Transit

This isn’t Mizrachi’s first crypto move. Back in early 2025, Panama City passed a sweeping bill allowing residents to pay taxes, parking fines, bus fares, and permits in Bitcoin, Ether, and stablecoins. The system goes live this November. The city even created licensing rules for Virtual Asset Service Providers (VASPs) to operate legally. But here’s the twist: Panama still has no comprehensive crypto law. The Financial Analysis Unit (UAF) enforces AML/KYC rules, but the Superintendence of Banks says digital assets fall outside its jurisdiction. It’s a regulatory gray zone—messy, but functional.That’s why Mizrachi is borrowing from El Salvador’s playbook. When President Nayib Bukele declared Bitcoin legal tender in 2021, the world laughed. Now, El Salvador holds over 3,000 BTC in its national reserve. Mizrachi openly admits he’s inspired. "They did it. Why can’t we?" he told reporters after his Las Vegas speech.

Who’s Behind the Proposal—and Who’s Stalling

The original pitch came from Max Keiser, a veteran crypto commentator and advisor to Bukele. Keiser’s analysis, cited by CoinDesk and Cryptoslate, shows that incentivizing Bitcoin payments could turn the canal’s revenue stream into a crypto magnet. He’s not just dreaming—he’s mapping out the math. A 5% discount on fees, he argues, would still leave Panama with more net revenue than before, thanks to Bitcoin’s volatility and potential appreciation.But the real power move? Getting the Panama Canal Authority on board. The Authority, which runs the canal independently of the city government, is still reviewing the proposal. Sources say internal discussions are tense. Some officials worry about exchange rate risk. Others fear international backlash from the IMF or U.S. Treasury. But Mizrachi isn’t backing down. He’s assembled a task force with tech firms like Bitbo and Lightspark, which built a Bitcoin payment infrastructure using the Lightning Network. Their goal: make Bitcoin transactions fast, cheap, and seamless—even for million-dollar canal fees.

What This Could Mean for the World

If implemented, this would be the first time a major global trade artery accepts Bitcoin for core operations. Not just a side experiment. Not a pilot. A full-scale, revenue-generating model. Imagine: a Chinese container ship pays its $300,000 toll in BTC, cuts 48 hours off its wait time, and saves $15,000. Other shipping giants take notice. Soon, ports from Singapore to Rotterdam start asking: "Why not us?"And Panama? It becomes a fintech hub. Not just a transit zone. A digital gateway. Already, the country is seeing a surge in blockchain startups. The government is quietly courting crypto exchanges. Banks are hiring blockchain specialists. Even the local university added a course on crypto economics.

The twist? This isn’t about replacing dollars. It’s about augmenting them. A hybrid system. Fiat for the cautious. Bitcoin for the agile. And if Bitcoin surges in value? Panama’s reserve grows without spending a single cent of public money.

What’s Next? The Timeline

The city’s crypto payment system launches in November 2025. The canal proposal? That’s on a tighter clock. Mizrachi says he expects a decision from the Panama Canal Authority by January 2026. If approved, a pilot phase could begin as early as March 2026, starting with just five major shipping lines. Full rollout? By late 2026.But here’s the real question: will the U.S. react? After all, the canal’s fees are denominated in dollars. And the dollar is still king. If Panama starts moving billions in crypto, will Washington push back? Or will it quietly watch—and learn?

Frequently Asked Questions

How would Bitcoin payments actually work at the Panama Canal?

Ships would use a digital wallet linked to the Panama Canal Authority’s payment portal. Transactions would settle via the Lightning Network for speed and low fees, with real-time conversion to USD for accounting purposes. The canal would hold Bitcoin in cold storage, not immediately liquidate it, allowing it to grow as a strategic reserve. Payment confirmation would trigger automated priority scheduling.

Is Panama’s crypto environment stable enough for this?

Legally, it’s a gray zone—no comprehensive crypto law exists, but AML/KYC rules are enforced by the UAF. Businesses must register as VASPs, and all transactions are traceable. The lack of a central bank mandate actually helps: it avoids bureaucratic delays. Panama’s track record with offshore finance gives it credibility, and the city’s 2025 bill provides enough structure to move forward cautiously.

What’s the risk if Bitcoin’s price crashes?

The canal wouldn’t hold Bitcoin long-term as a primary asset. Instead, it would convert a portion to USD daily to cover operational costs. The rest would be held as a reserve, with a policy to only sell during market peaks. Even if BTC dropped 30%, the discount offered to shippers would still generate net revenue gains due to increased volume and reduced congestion costs.

Why hasn’t this been done before?

No other major port has the combination of autonomy, geopolitical neutrality, and tech-savvy leadership that Panama does. Singapore is too regulated. Rotterdam is too conservative. The Suez Canal is controlled by a state-owned entity with little appetite for innovation. Panama, with its history as a financial crossroads and its recent crypto-friendly legislation, is uniquely positioned to take the leap.

Could this lead to other countries following suit?

Absolutely. If Panama sees a 12% increase in transit volume and $200 million in additional revenue from Bitcoin users, ports from Dubai to Rotterdam will start drafting similar proposals. The first mover advantage is massive—especially if shipping companies begin demanding crypto payment options as a standard feature, not a novelty.

What’s the biggest obstacle to implementation?

The biggest hurdle isn’t technology—it’s politics. The Panama Canal Authority is cautious, and U.S. Treasury officials are watching closely. Any move perceived as undermining the dollar’s dominance in global trade could trigger diplomatic pressure. Mizrachi knows this. That’s why he’s framing it as an efficiency upgrade, not a currency rebellion.